The most important criteria in my opinion during home hunting would be housing affordability.

The most important criteria in my opinion during home hunting would be housing affordability.

It is alarming that most would be purchasers do not address this concern first before selection of homes.

Sometimes even leaving it to the last minute.

Given the amount of funds one has to fork out during the purchase of property, we ought to give it more thought wouldn’t you agree?

And, it’s also more efficient. You wouldn’t want to spend time scrambling to confirm your affordability only after you’ve seen something you like. Because in that time spent, someone else might have taken that unit.

Speed and timing are critical factors that determines a right move.

Thus I recommend all home seekers to speak to a banker before they start their home search. Through an assessment by the bank, they are able to get an In-principal Approval(IPA). The IPA is an indication of how much an individual is able to finance in their upcoming property purchase.

With the IPA, it will simplify decision making tremendously as buyers will be able to know their financial standing and able to target better home units.

To help you get started, this article briefly explains 2 methods of calculating housing affordability, finding your Max Purchase Price and how to put it both together.

There is a bonus at the end as well!

-

The Asset Method

The first method involves finding your affordability based on your assets.

For Singaporeans, typically these would comprise of cash on hand, and CPF in the ordinary account, the latter seen as “money that can’t be touched” by most.

Whether or not it is advisable to use CPF for your housing payments, and what are the things to look out for, that is a whole other discussion on its own.

Notes:

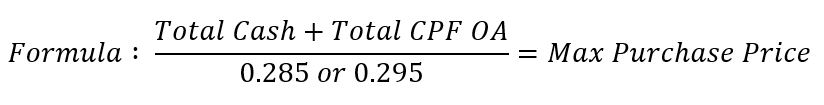

1) This formula is based on the current MAS ruling as of the date of this article.

2) A minimum cash of 5% of the property purchase price is required.

Also, since 6 July 2018, Singapore government had tightened loan limits to 75% from the 80% previously vs the property’s valuation or purchase price, whichever is lower.

Therefore, the components of the purchase price required are:

Buffering a 0.5% cost in case of unexpected expenses or complicated purchase structuring, the total amount required upfront should lie safely within 28.5% or 29.5% of the purchase price, depending whether it’s a <$1m purchase or above.

2. The Mortgage Method

The other way, is where the banker’s IPA comes in. Here, you find out on your max loan affordability first, before assuming the highest loan to value (LTV) of 75% in order to compute the Max Purchase Price.

The key factor to understand is the Total Debt Servicing Ratio (TDSR). Introduced by the Singapore government to ensure that citizens are not over leveraged, the framework caps the percentage of your income that can go into servicing debts. At time of writing, it is 60%.

While there are many calculators for TDSR out there, as a quick google will show, my main purpose of this section is to provide clarity on how certain types of income and debt should be considered, followed by an example.

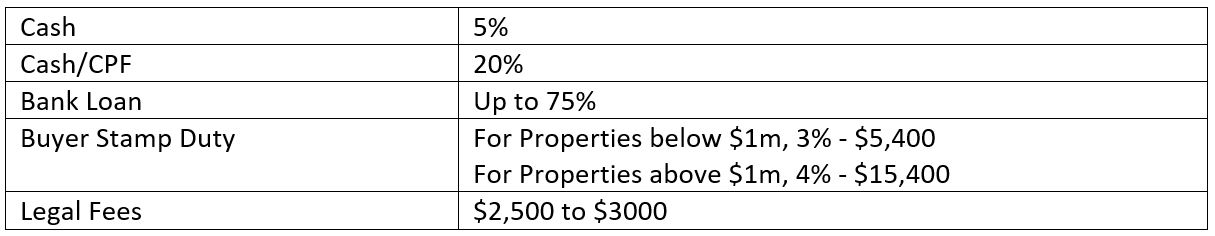

Income Considerations

*There is a 30% haircut for variable income.

Note: other methods such as pledging and asset based lending are not within the scope of this article.

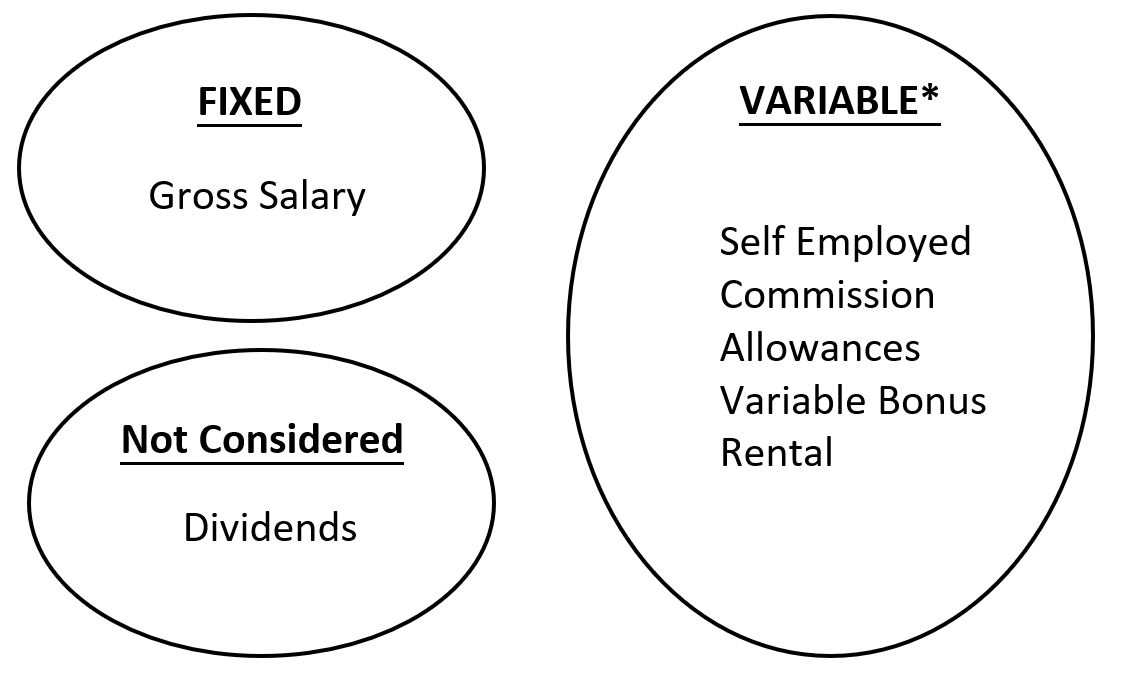

Debt Servicing Considerations

When it comes to debts, it is not as straightforward because the bank will assess your Credit Bureau Report upon application. Bad credit history recorded will have an impact on financing your next loan. Depending on the nature of guaranteeing a debt, it could also be within the report. Credit card obligations also varies, while some banks subjecting a $50 monthly debt on all cards, while other banks only consider the actives ones depending on usage.

Let’s look at an example:

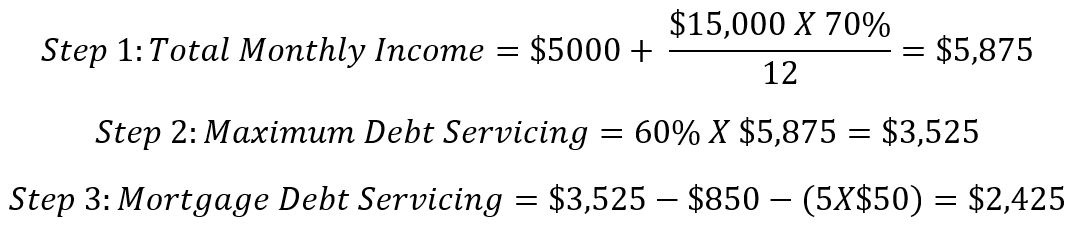

John aged 45 ,fixed monthly gross income $5,000. Variable bonus $15,000.

Owns a car with installment $850 per month.

Has 5 active credit cards.

How much is his maximum monthly mortgage and his max loan?

For his max loan, using a compound interest calculator,

Based on 3.5% interest rate stress test and 20 years tenure up to age 65, you get $418,132!

Consequently, max purchase price = $418,132/0.75 = $557,059

*assumes max Loan To Value of 75%.

3. Putting It All Together

Well, unless you’re paying in full for the property, you can’t just use 1 method or the other. They have to go hand in hand.

Most importantly, you must take note of the source of funds order.

CASH ➡ CPF ➡ BANK LOAN

Meaning, you have to use cash first, before CPF, and finally the bank loan.

How this actually matters is during scenarios where you are not taking the maximum LTV. for example the property price is $1mil, your max loan eligibility is $400k and you have $200k CPF.

You will therefore need to first have the remaining $400k + stamp duties + legal fees in cash before you can safely execute this purchase.

If it is a new project that is in the building stage, you might still have time to raise the funds.

However for a resale property, you would not be able to execute the purchase.

I hope the above is good enough to get you going!

Now remember that little bonus I mentioned at the start?

If you’re an existing property owner, I’ve got a Property Upgrading Blueprint for you!

It’s something that I’ve used multiple times to plan for my clients.

Inside contains the step by step instructions and calculations on how you can upgrade, without touching your savings and still have a reserve fund!

And I’m giving it away for FREE!

I’m sure you’ll find it useful.

All you have to do is to click the link HERE, enter your name and email address, and I’ll send it directly over to your mailbox!

Ask Jim

Ask Jim