Well, I must admit, this was one of the least conspicuous book on the shelf.

It was quite tiny and easy to miss, especially in contrast to the sheer numbers of real estate guides and property investing how tos.

See! It only fits into the palm of my hand.

Still somehow, I picked it up.

The title, Powering Your Property Tree was nice, but what made me decide to read it was the second portion: Perspectives From A Seasoned Mortgage Professional.

I thought, ‘it’s nice to read the commentary from a mortgage professional for a change’.

So now that I’m done, this article is less of a review, and more of a highlight sharing, where I talk about the segments which I found more intriguing.

And at the end, sharing my overall brief thoughts on the book.

Hopefully, providing you some insights in the process!

1) Factors Conducive To Property Purchases And What Drive Real Estate

· High Employment Rate

· Low Interest Rate Environment

· Government Policy & Tools

· Favourable Population Growth Policies

· Support From Locals And Foreigners (Market Demand)

· Good Liquidity In The Region

· Future Potentials Of The City State

And, some key questions to ask:

· What are the growing needs and evolving trends of everyone’s needs and wants?

· How do these evolving trends impact property selection?

· What do we look for when selecting a property?

· Which location interests us and so on?

This segment stood out as in my opinion, the above factors don’t apply only to Singapore, but also to anywhere around the world.

It can serve well as the fundamental tenets of property investing in any location globally.

Particularly for Singapore Real Estate, the following points make us attractive

-

The Extent Of Home Ownership

-

Government Objectives And Policies

-

Strong Infrastructure And Extensive Transport Network

-

Strong Economic Fundamentals

-

Political Stability

-

Strong And Stable Singapore Dollar

-

The Attractiveness To Foreign Investors As We Become A Financial Hub

-

Transformation Into A Thriving And Vibrant Tourist City

Of course, by now, 5 years after the book was published, Singapore has kept growing and maintained course to be a financial hub of the region, as well as a top tier tourist city. (if we are not already there yet ????)

These are just part of some reasons why the country is one of the top choices for foreigners to move to. I explored these in the article Top 10 Reasons Foreigners Move To Singapore.

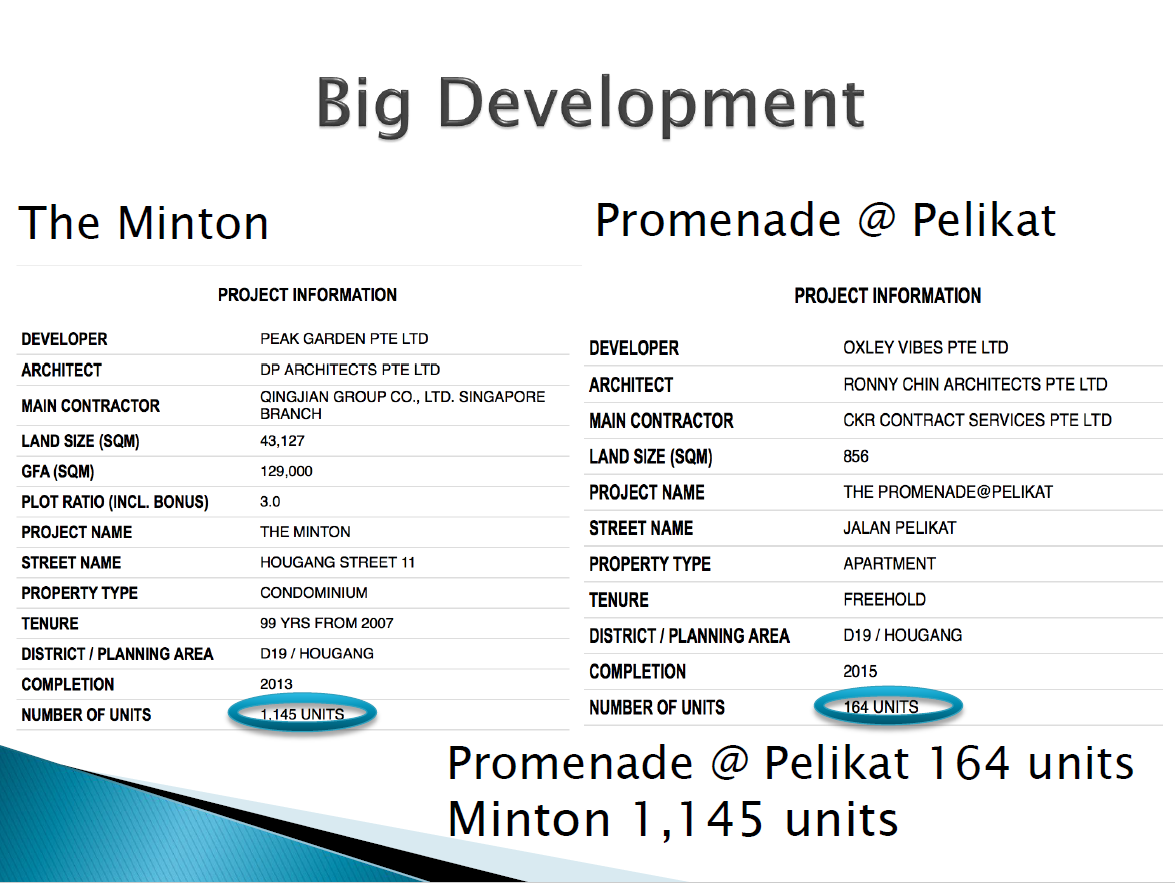

2) How Condo Land Size & Number of Units Matter

This was particularly relevant in today’s market (2019) due to the high volume of mega projects coming onto the market this year.

Interestingly, in the book it states that ‘A development that has more than 500 units is considered a big project’.

Today, more than 500 is a norm and the mega projects have units which exceed a thousand.

The biggest, Treasure At Tampines, even exceed 2,000 residential units!

So, for any reader still wondering what’s the pros and cons of a big vs small condo land size development, here’s the answer:

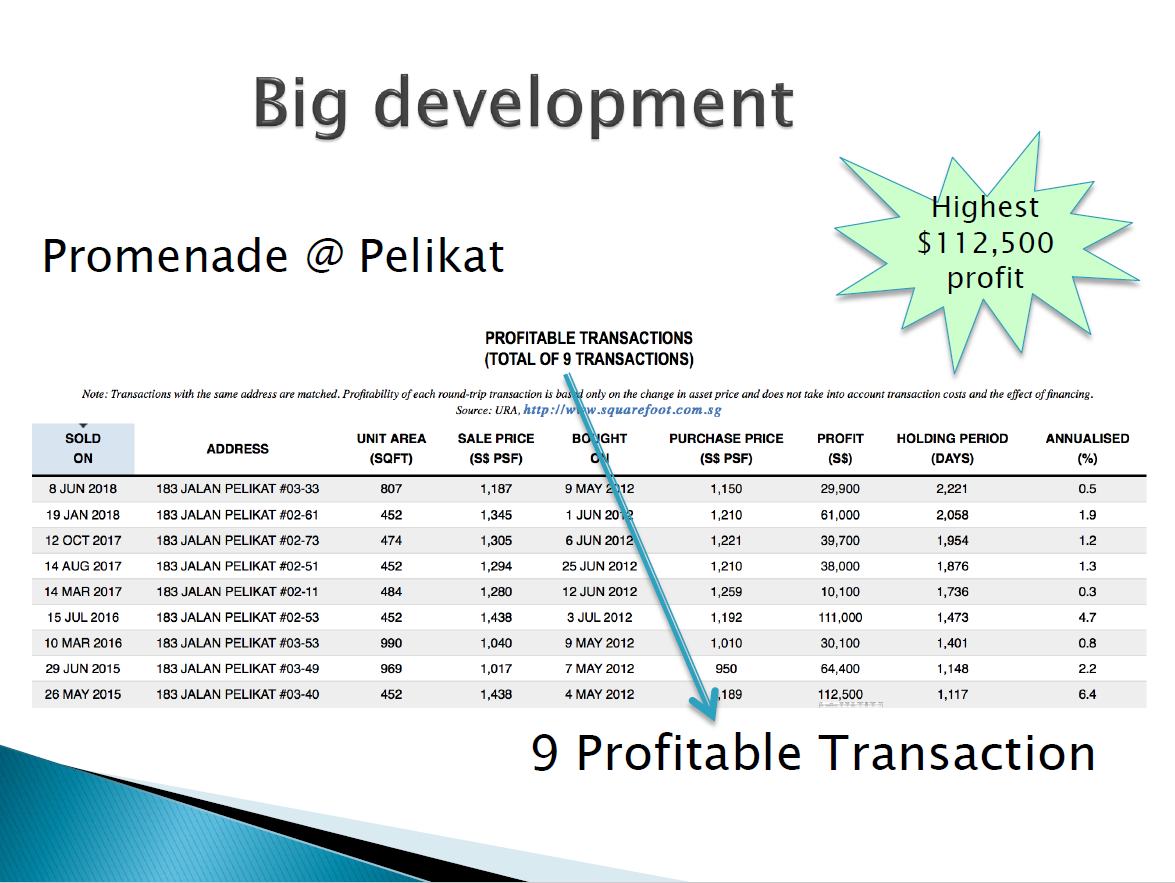

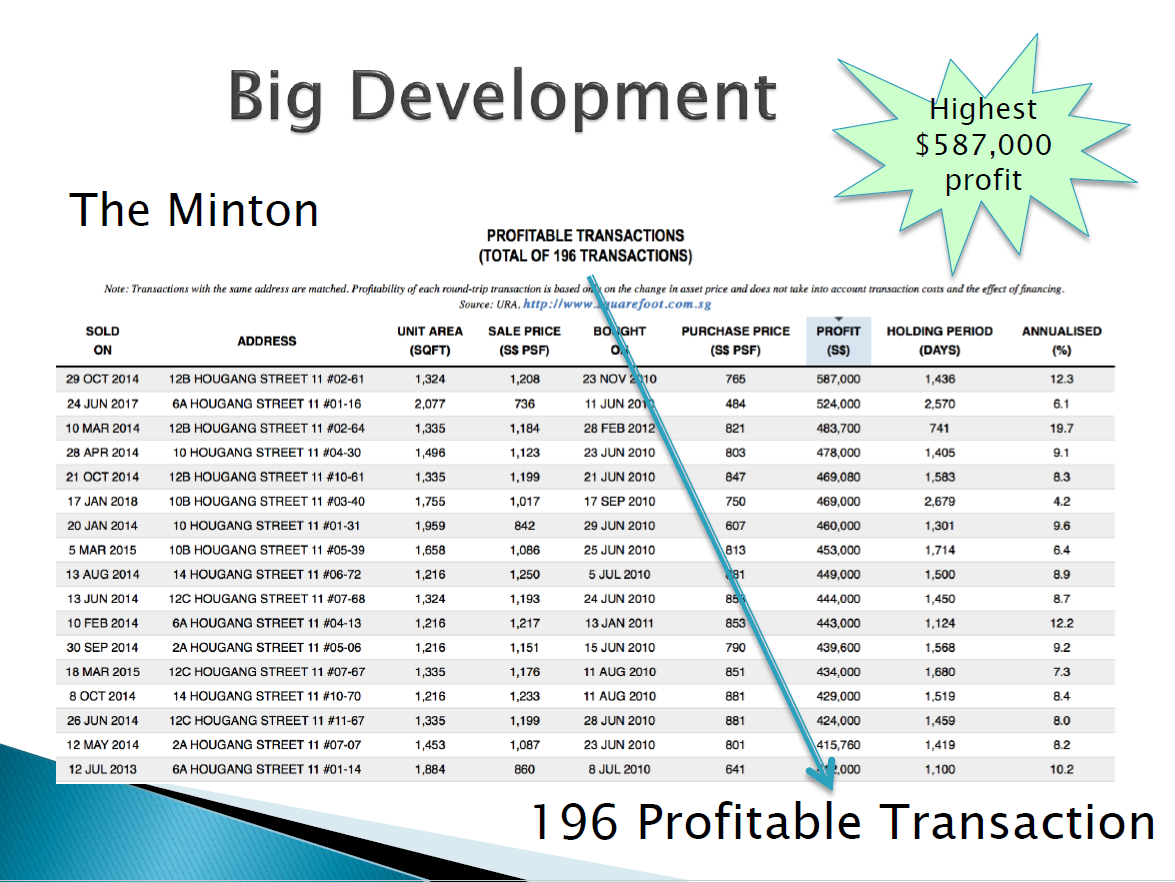

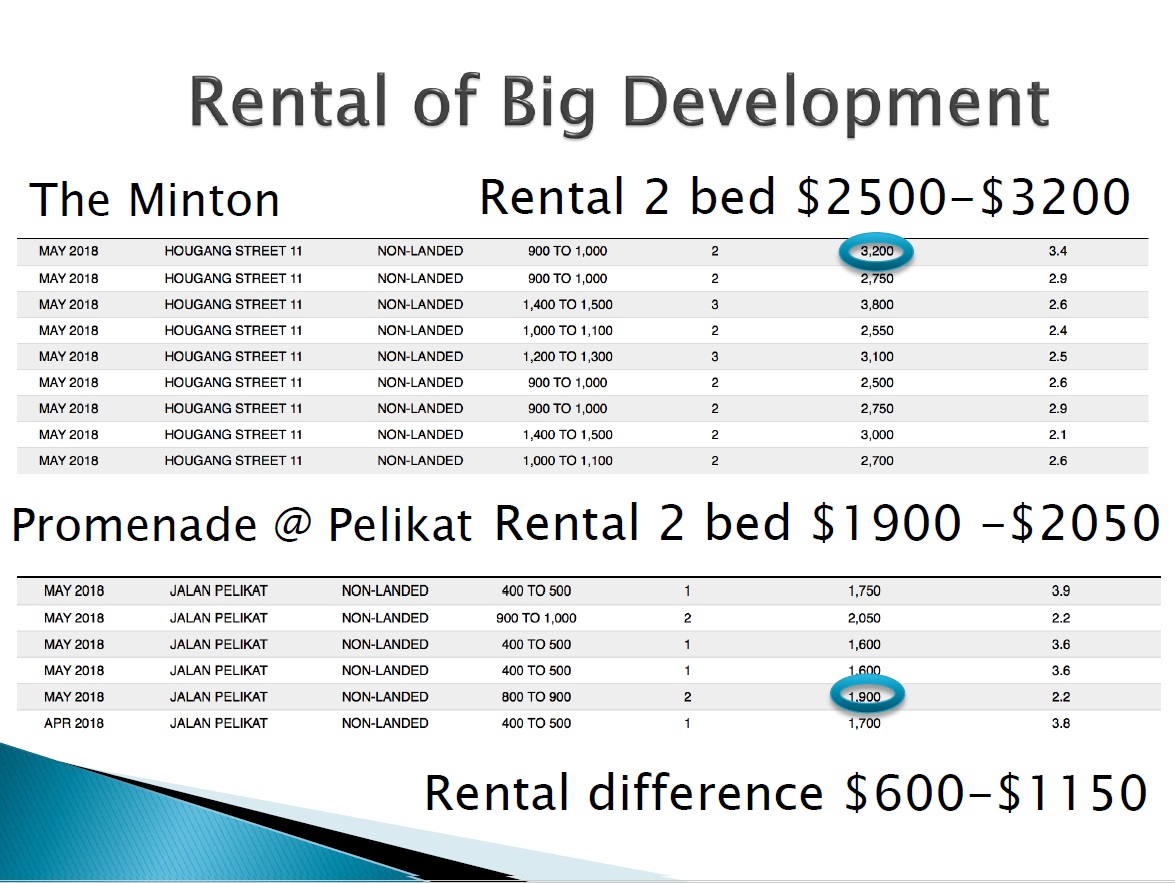

For a large project with more units, there will be stiffer competition and smaller opportunities to fetch good rental returns. Similarly, sales opportunities will be affected by an increase in the number of competing units too.

However, in bigger projects, there are more transactions put up for sale thus enabling the value/price of the property to be established and appreciate at a quicker pace than prices in a smaller development.

Most valuation professionals in today’s market value properties by taking the average of the recent transacted prices of the development to gauge the value.

Small developments usually have fewer transactions thus it is difficult to gauge their actual value.

—

In summary, transaction volume drive prices.

Let’s look at an example in the Small Project vs Big Project comparison:

Also to add on, while the author mentions there are downsides with large projects due to more intense competition and less opportunities, there are also a wider range of facilities which offer lifestyle options which appeal to both tenants and owner occupiers alike.

With a larger owner pool, maintenance fees are also less.

3) Cooling Measures – Who’s Unaffected?

Caught on by the author, first-timers are not subjected to these cooling measures.

And even till now, as more cooling measures have come into play since the writing of the book, first-timers remain unaffected.

It’s as if you’re have a 100m head start in a 400m foot race.

While almost all other categories of buyers start with a larger tax outlay, the first-time buyer is able to purchase at 0% additional tax, highest loan to value limits, and likely little to none TDSR restrictions.

For more on this, I wrote something about understanding your housing affordability.

This translates into higher possible gains in future.

To the untrained eye it may seem like property prices have not changed much since the same time last year.

In reality, developers are not immune to the market sentiment and cooling measures and have reduced prices by 10-15% in some cases.

For upcoming launches, the launch pricing could also be up to 20% less than their initial expectations.

Resale on the other hand tends to be slower to react as ownership and pricing is not centralised.

Pricing is instead more dependent on a concept I call “follow your neighbour”.

That could explain why developer units are still selling well while resale transactions are stalling.

You can read more on my New Launch Vs Resale Condo Series.

Still, there will always be a certain group of buyers who would be waiting for ‘that crash’.

Here’s what the author said then, about the TDSR framework:

“their hopes may well be in vain if developers continue to have strong holding power. Many reckon that Singapore’s economy is yet to go down and the global economy may not worsen and that there will still be good employment in the foreseeable future. Moreover if population growth is in line with the expected annual numbers intended by the Singapore government, there will be ample support for housing demand in Singapore. It is likely that as long as full employment continues and there is strong purchasing power, demand for housing will continue to persist and property prices will sustain.”

Do you agree?

I personally am feeling a little mixed with this statement.

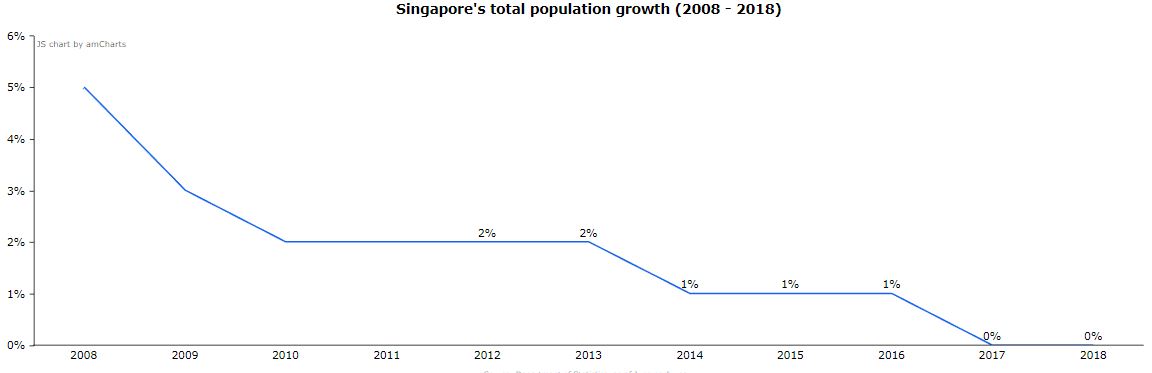

Firstly, her population growth expectation is likely related to the Population White Paper published in 2013. The paper indicated a target of 6.9M by the year 2030.

However as of now, here’s the figures from Population.sg

Total Population: 5.64 mil

To hit the figure of 6.9M by 2030, an approximate 2% per annum population growth rate is required.

Here’s the actual growth rate over the last 10 years.

There is clearly some turnaround required and I think we need it, and thankfully the government is doing something about it.

There has been plenty of infrastructure investments, which in my view are in preparation for more people.

We’re facing an ageing population and the government knows we need more people.

Birth rates aren’t increasing, so the only other option is immigration.

A whole other topic in another article ????

As for developer’s pricing, it’s harder to say.

So far they’ve been holding strong though, and buyers are still coming in, albeit slower.

Margins are already very thin and if pushed between selling at a loss vs paying the tax on units left unsold?

I know developers who took the latter option. Or, did bulk sales of remaining units during the last time such situations came about.

Thereafter waiting for the market to turn before selling again at a higher price.

Sometimes it’s not just about the money. It’s also about reputation.

Price reductions after a large number of sales will anger the earlier buyers who may have had ‘early bird discounts’.

That’s a roundup of the book by Yip Woon Lye, Powering Your Property Tree (Perspectives From A Seasoned Mortgage Professional)

I also added much of my own thoughts therein, and some things not mentioned in the video.

Once again, if you like my content do subscribe and join my community!

—

Looking for more clarity on the Singapore market?

One of my offers is a presentation where I go through the secret statistics of the Singapore market that almost no one knows about…

…which will certainly put you ahead of most people in the market, agents included, all without pouring through heavy research reports.

All you have to do is click here, and enter your name and email address to get immediate access to the presentation!

Ask Jim

Ask Jim